UC People: Maia Ferdman, radical optimist

October 20, 2025

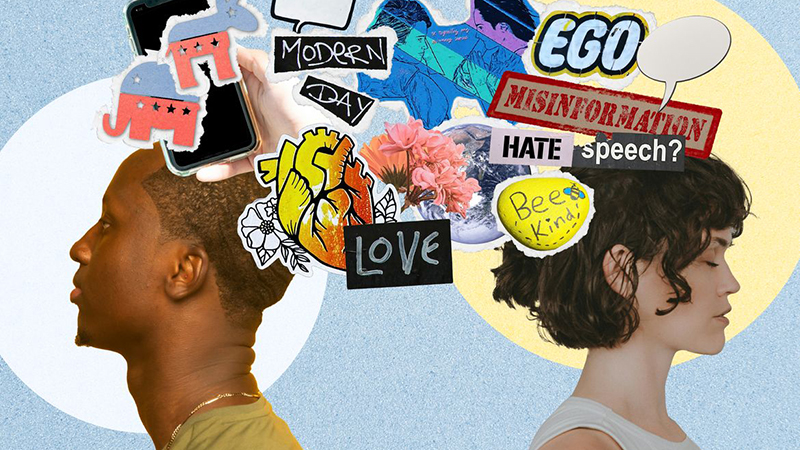

Bruin alumna Maia is tackling the extraordinary divides of our time by teaching students to engage in honest and authentic conversation.

UCnetwork: October 2025

October 16, 2025

Read our University of California systemwide staff newsletter for updates on staff achievements, research, benefits and more.

UC Procurement releases an accomplishment-filled annual report

October 14, 2025

UC systemwide and campus procurement teams source critical materials, forge strategic partnerships and provide value far beyond cost savings.

UC Spotlight: October 2025

October 14, 2025

Learn how UC staff are bringing UC’s values to life and making a difference for Californians and the world beyond our state.

Big changes and new choices: Five things you need to know before Open Enrollment

October 14, 2025

Open Enrollment is from 8 a.m. on Thursday, Oct. 30, through 5 p.m. on Friday, Nov. 21, and there are some big changes to UC’s …

Mensaje sobre los cambios en los beneficios de 2026

October 14, 2025

Estimados colegas: Dado que el período de Inscripción Abierta comienza el 30 de octubre les escribo para informarles sobre algunos cambios significativos para el próximo …

Center for Data-driven Insights and Innovation releases impact-filled annual report

October 14, 2025

CDI2 has deepened its collaborations across the university and our state to support many critical areas that impact all communities.

Oct. 22 CUCSA All-Staff Town Hall will focus on Open Enrollment

October 13, 2025

This virtual event will feature a presentation of 2026 Open Enrollment, including changes to this year’s benefits, by Systemwide HR.

UCnetwork marks 75th issue with a reader survey

October 13, 2025

Whether this is your first or 75th time reading UCnetwork, we want to hear from you about what you love and what we can do better.

7 tips for voting in California’s Nov. 4 special election

October 11, 2025

Do you know what you need to do in order to vote this November? Take a moment to review this simple checklist.