A holistic approach to health for every stage of women’s lives

May 1, 2025

Women’s health needs evolve over time, requiring personalized care at every life stage. Get expert advice about steps you can take to maintain your well-being …

CUCSA shares recording of town hall featuring Regent Anguiano

April 29, 2025

UC Regents Vice Chair Maria Anguiano spoke about her background, university governance and the challenges ahead of UC.

UCnetwork: April 2025

April 23, 2025

UCnetwork is emailed monthly to University of California staff, but all members of the UC community are invited to subscribe. Get UCnetwork delivered to your …

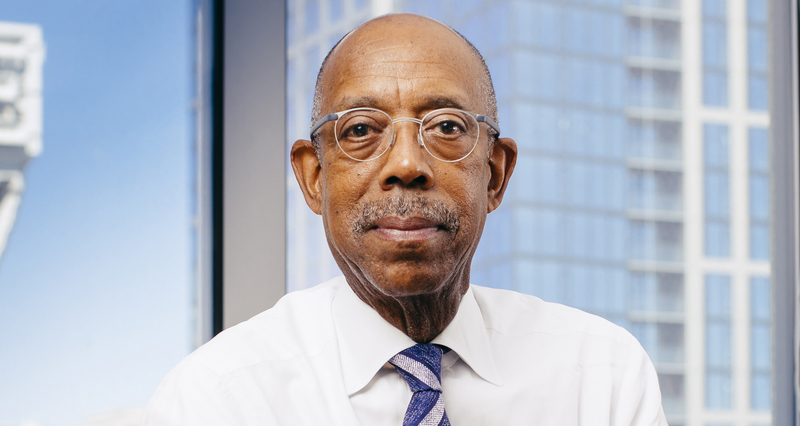

From President Drake: The strength that built us will sustain us

April 23, 2025

Dear University of California community, The last several months have challenged our university community in many ways. We find ourselves in a moment that requires …

UC Spotlight: April 2025

April 16, 2025

Our monthly UC Spotlight celebrates the UC locations, teams and individual staff members who are helping to make UC a great place to work.

UC Santa Cruz Science Division staff honored with new service award

April 15, 2025

Jeannette Peters, Patti Schell and Deana Tanguay of UC Santa Cruz share the Science Division’s first Outstanding Staff Award.

CUCSA celebrates extraordinary UC colleagues

April 15, 2025

Congratulations to the recipients of the Council of UC Staff Assemblies’ annual awards for extraordinary staff achievements.

May 15: Attend a UC Global Accessibility Awareness Day event

April 14, 2025

Whether you’re just starting to understand digital accessibility or staying current on trends, this year’s UC GAAD event is for you.

Research-proven steps to pollution-proof your skin

April 11, 2025

You just need a few essentials to fend off pollution-related issues and give your skin the support it needs.

UC People: Mike Vigo, mission-based finance leader

April 10, 2025

Miguel “Mike” Vigo IV, chief revenue officer at UC San Diego Health, leads financial strategies that support exceptional patient care.