UC ANR–led initiative named semifinalist in National Science Foundation competition

July 18, 2025

By pairing advanced analytics and biotechnology with practical expertise, the Engine helps keep farms profitable, reinforces local supply chains, and opens new career paths in rural communities.

Dr. Dennis Assanis appointed as UC Santa Barbara’s next chancellor

July 17, 2025

The University of California Board of Regents today approved Dr. Dennis Assanis as UC Santa Barbara’s sixth chancellor. He will assume his role on September …

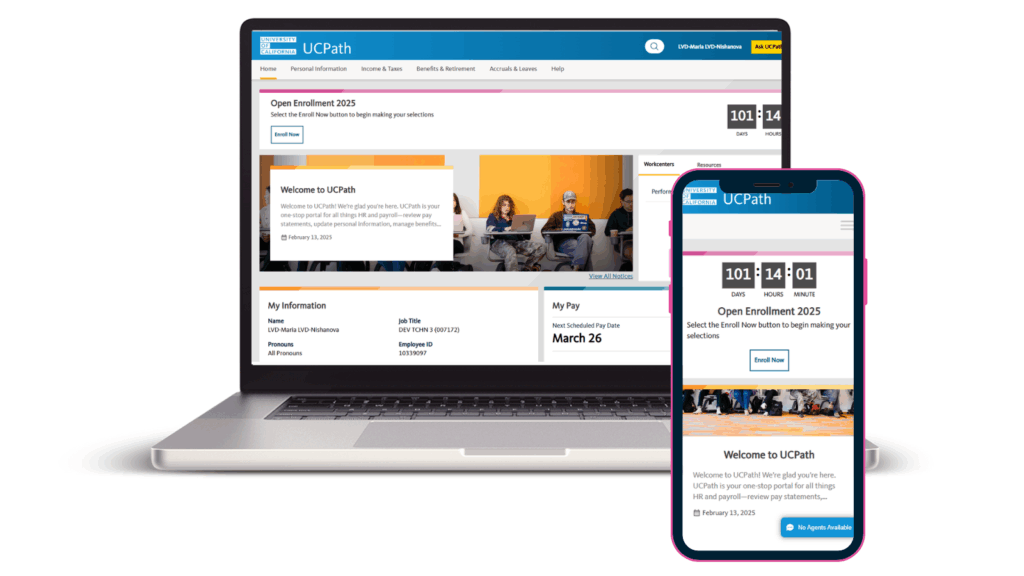

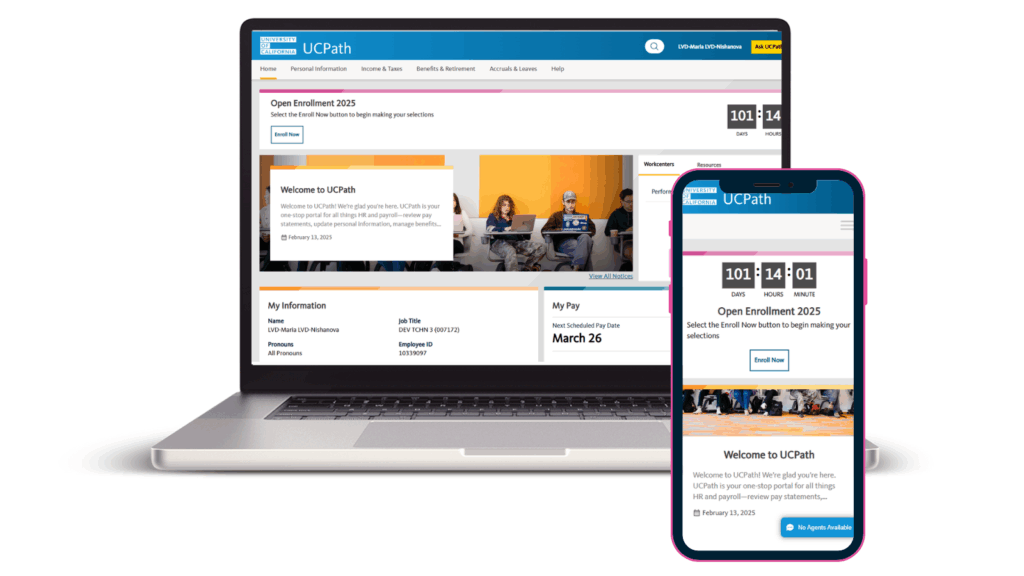

UCPath has a new look to better serve you!

July 15, 2025

UCPath’s new, modern portal design to help UC employees and retirees more easily access pay, benefits and personal information.

Christopher Witko named executive director of the UC Center Sacramento

July 15, 2025

Mission-driven leader Christopher Witko will begin his role as executive director of the UC Center Sacramento on Sept. 1, 2025.

David Gonzalez, third-gen UC employee

July 8, 2025

David has worked at UCSF for 27 years, and helps out with almost every aspect of a Dentistry student’s journey.

UCPath is getting a new look! Here’s what to expect, including downtime.

July 7, 2025

UCPath’s refreshed layout, improved navigation and responsive design will make it easier than ever to access and update your information.

Council of UC Staff Assemblies shares spring quarterly meeting update

July 7, 2025

CUCSA’s spring meeting featured conversations with UC leaders, workgroup presentations and updates on matters of interest for UC staff.

Wondering if that ‘financial adviser’ is trustworthy? Read this.

July 3, 2025

It’s easy to confuse unauthorized advisers with UC-contracted financial planning services.

Advisory for non-essential travel within the Middle East North Africa (MENA) Region

July 3, 2025

Updated travel advisory for the MENA Region issued on July 3, 2025, by Nathan Brostrom, Executive Vice President and CFO, and Kevin Confetti, Associate Vice President & Chief …

The University of California mourns the passing of former UC President Robert C. Dynes

July 2, 2025

The UC community is deeply saddened by the passing of former UC President and former UC San Diego Chancellor Robert C. Dynes.